[This post originally ran on Always Add the Egg]

Sometimes it feels like no matter what I’m talking about the conversation steers into pricing. I can’t help myself. I get so fired up about pricing.

Most founders agree it’s important, yet we usually get it wrong.

I’m always learning and refining my thinking, but I come back to some frameworks again and again. The first?

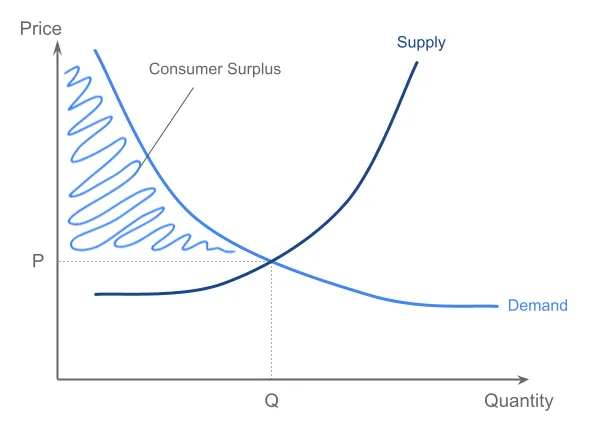

Don’t price where the supply and demand curves intersect. Instead, set as many prices as you can ALONG the demand curve.

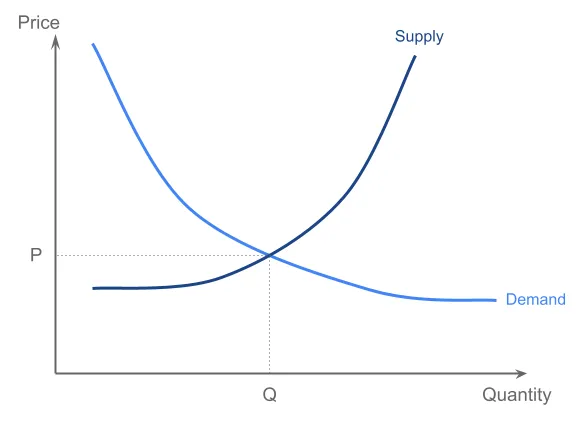

Economics 101

In microeconomics, we learn that the market-clearing price and quantity of a good or service should be set where your supply and demand curves intersect. In other words, produce where the number of units you could sell (Q) at a specific price (P) equals the number of units you are willing to make at that price.

From what I can tell, this is the default starting point for most companies beginning their pricing journeys. New products in the real world don’t have clear supply and demand curves, so we ask questions like:

- Where am I priced relative to my competition?

- How much would customers be willing to pay?

- Is there enough value at this price?

These questions help us understand demand. (The supply curve is often ignored in the early days of venture-backed startups.) This is a good starting place. It's straightforward. Unfortunately, it leaves a lot of value on the table.

The demand curve represents the willingness to pay for all your potential customers [1]. There is a better approach than pricing your product where supply meets demand. Instead, companies should try to set multiple prices along the entire demand curve and capture customers at every price they’re willing to pay for a product.

Economics 101 Learn From the Best

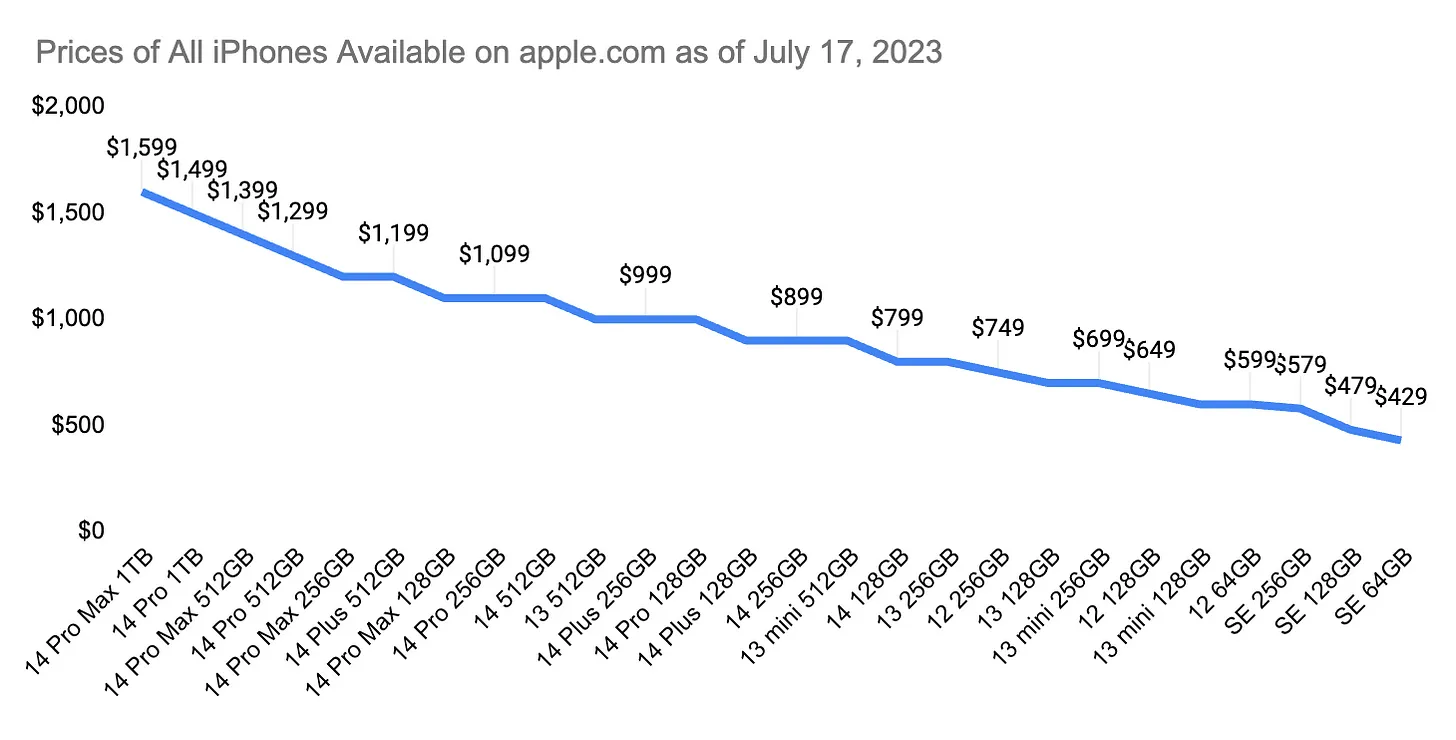

How is this done in practice? Let’s look at pricing for the iPhone in July 2023.

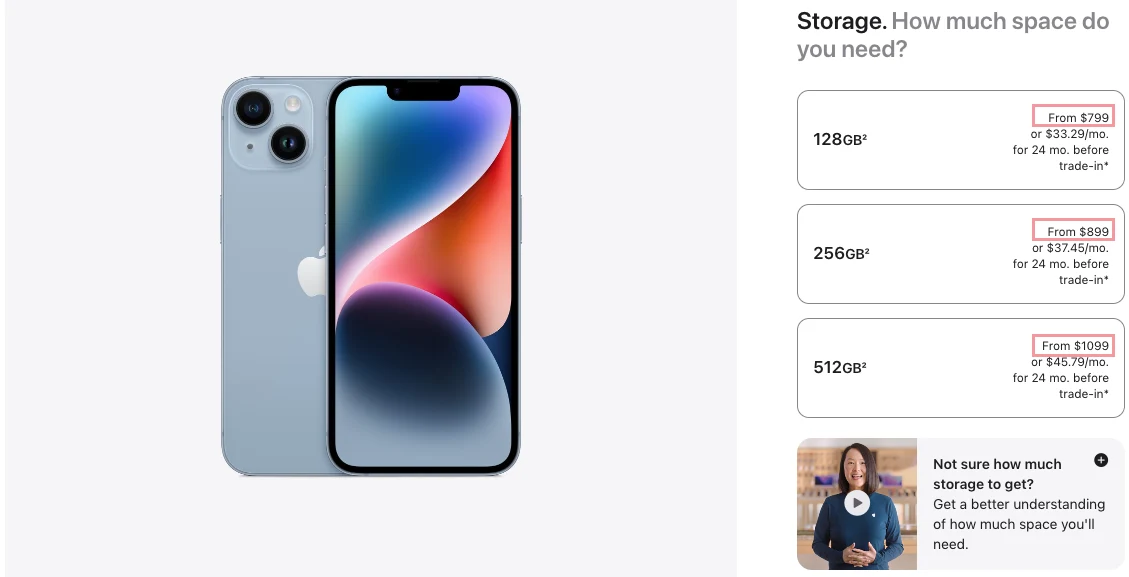

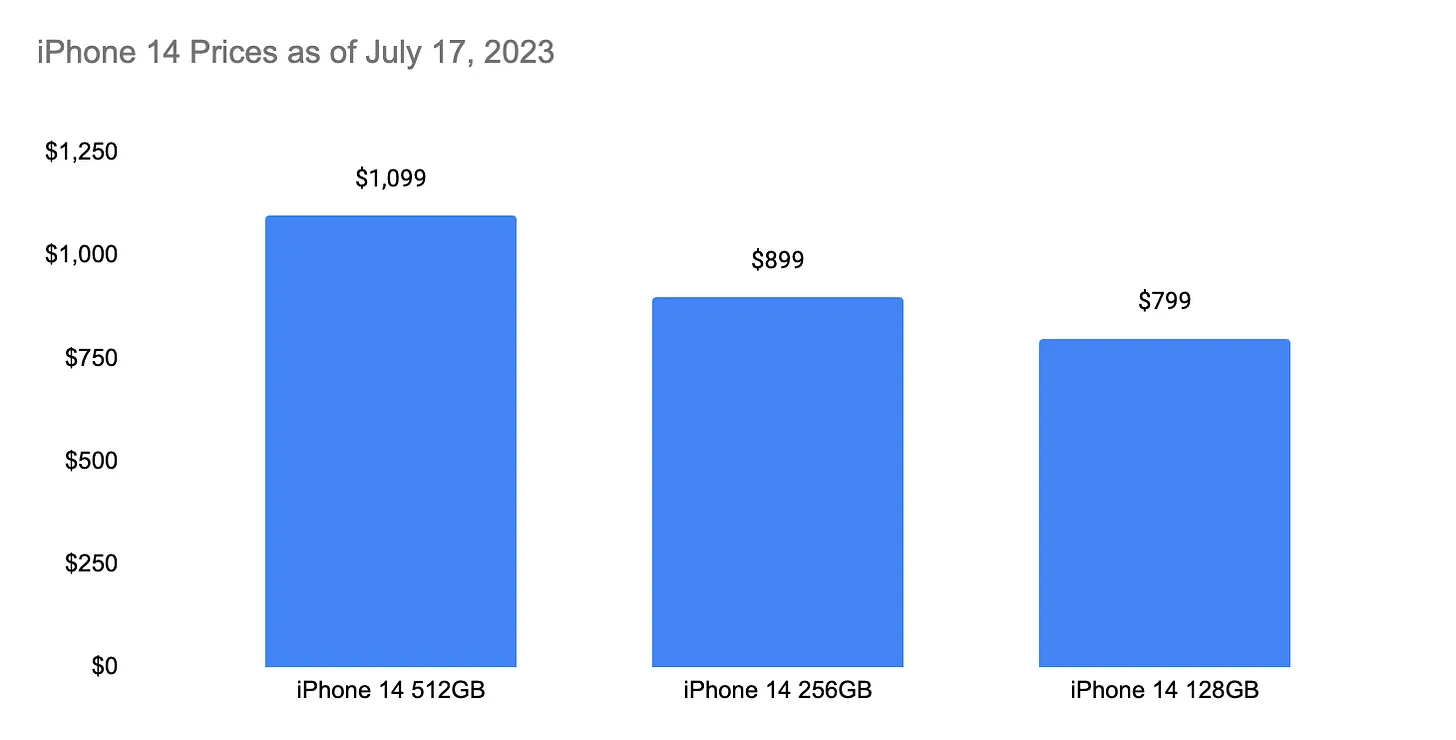

You can get the iPhone 14 for $799. Wonderful. You can also get the iPhone 14 for $899 or $1,099. Why would anyone pay $1,099 for a phone that you could get for $799?

Because they can, of course!

Sure, you get substantially more storage at these higher prices. But most iPhone users won’t hit capacity. At 512GB, you’re not getting storage as much as you are getting the peace of mind that you won’t run out. How much is that peace of mind worth?

It costs $300. Whether it’s worth it is up to you (and your willingness to pay). That’s why Apple sells three tiers of iPhone 14s that are essentially the same device. Rather than offering one with adequate storage, they capture more value by offering three. The 512GB version costs 37.5% more than the base model, but Apple knows some customers are willing to pay for it.

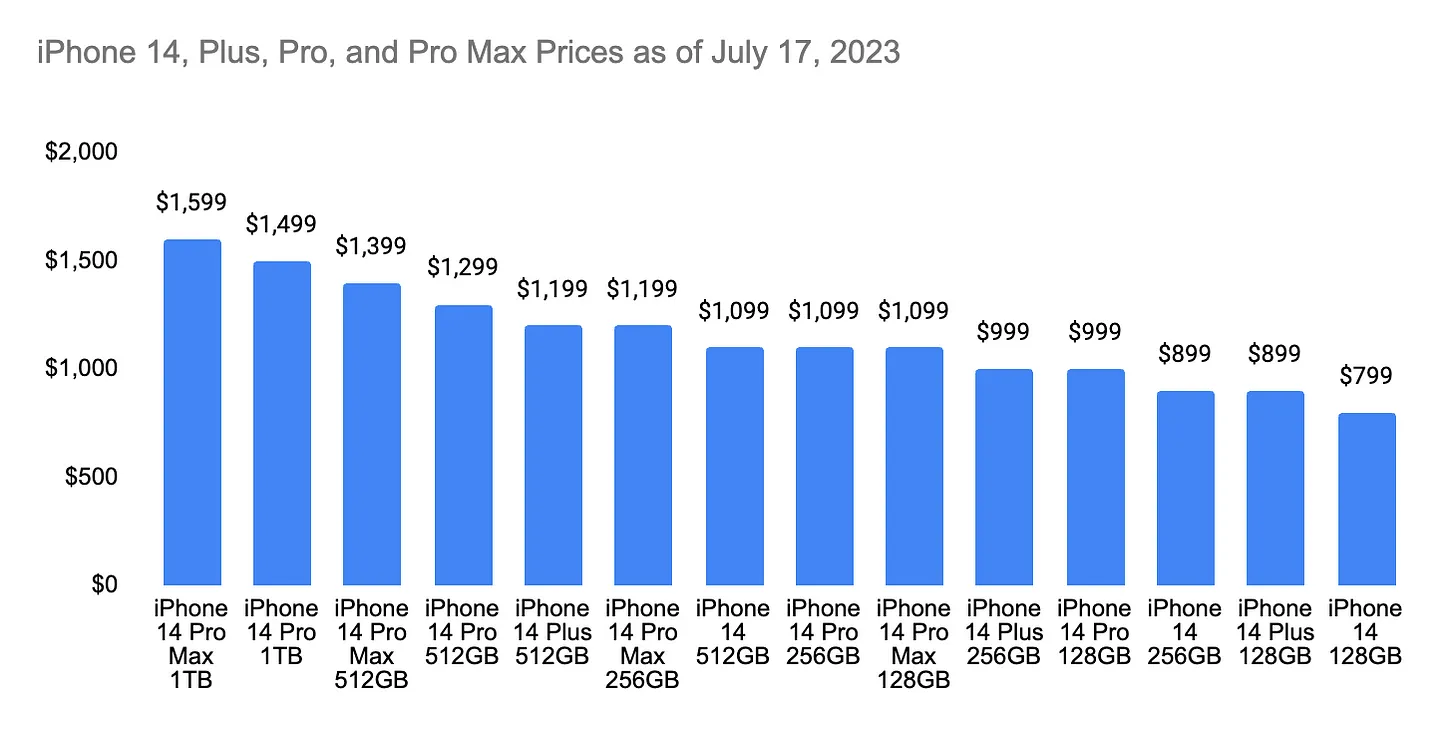

That’s not all. Introduce the iPhone 14 Plus, Pro, and Pro Max and Apple sells 14 models of the iPhone 14 at 9 different prices!

You might be thinking these are different products. The Plus and the Pro Max have bigger screens and the Pros have better hardware. That’s true, but you can pay anywhere from $799 – $1,499 for the small-screen iPhone 14 or $899 – $1,599 for the big-screen one. Apple has essentially made either version available at every price in their range.

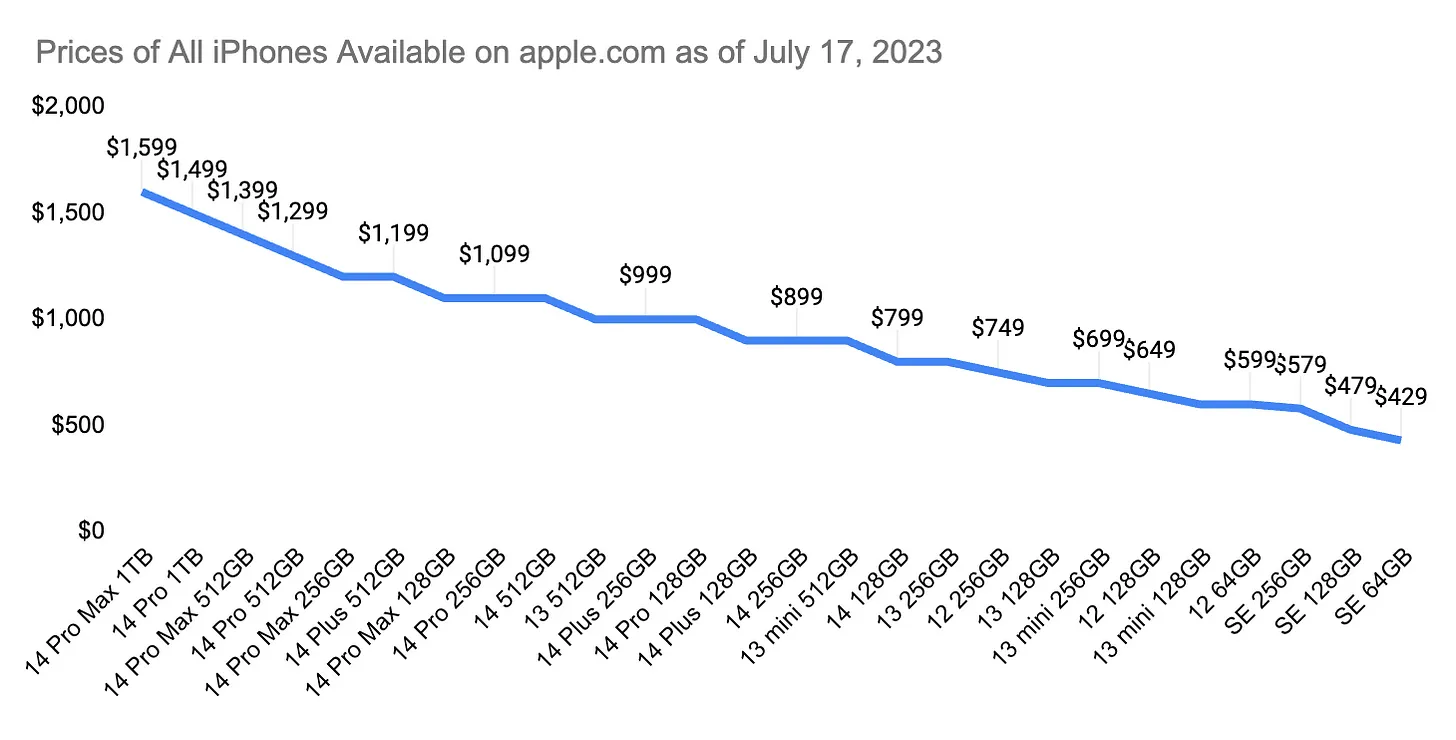

Add in last year’s iPhone 13, the “Special Edition” iPhone SE (Apple literally saying, “I give you special price”), and the two-year-old iPhone 12, and you can buy an iPhone from Apple for anywhere from $429 – $1,599. If Apple had followed Econ 101, they might have priced at $799 and offered a middle-of-the-road 256GB of storage. Instead, they sell iPhones at 17 different prices.

Look familiar?

Capture Value by Pricing Along the Demand Curve

In economics, the area above the price you set and below the demand curve is called consumer surplus. It is the excess value you are delivering to the customers who are willing to pay a higher price for your product. It is the value you are not capturing.

Apple is not interested in giving consumer surplus to customers willing to pay a higher price. Pricing the iPhone along the demand curve delivers that value to shareholders.

This customer segmentation drives gross margin for them as well. The larger NAND flash memory chips don’t cost them as much as the price increases for consumers, so a lot of that price increase flows straight through to gross margin.

This is the power of pricing along the demand curve.

I love this concept, and I could talk about pricing all day. Why pricing is a product attribute. Why it’s a brand attribute. How startups wait too long to charge at all and usually charge too little. More on that to come.

In the meantime, I’d love to know your strongly held beliefs about pricing. Let me know if there’s something you’d like to share or a question we can explore together.

[1] The demand curve represents the number of people (Q) who would be willing to pay a certain price (P) for the product or service. It is downward sloping because as the price goes up, fewer people would be willing to buy and as it goes down more people would buy.